Our Blog

Recent:

Increase Your Homes Curb Appeal and Let Expert Advice Guide You

If you're looking to sell your residence this spring, it may take more effort than in previous years. The housing market is different now - there are a greater number of homes for sale compared to the same time last year, but inventory levels remain historically low. Consequently, if a property stays on the market for an extended period of time without any offers, then it likely needs something else to draw in buyers' attention.

Currently, houses that are up-to-date and priced at market value still sell incredibly quickly. But the real key to success is curb appeal - making sure your house looks inviting from the street. Danielle Hale, Chief Economist at realtor.com even says homes with great presentation can be sold for over asking price in no time! Now more than ever it pays off to make sure your home stands out from the crowd if you're looking for a sale.

“In a market where costs are still high and buyers can be a little choosier, it makes sense they’re going to reallyzero in on the homes that are the most appealing.”

As the spring buying season is quickly approaching, it's essential to start prepping your house for sale. To ensure you are investing in improvements that will result in a great return, consider working with an experienced real estate agent who can assist you in understanding which renovations bring value to your unique local market.

Curb Appeal Wins

In order to maximize your return on investment, identify mini-updates that you can easily complete yourself. Curb appeal projects typically bring a great ROI and are a simple way to increase the value of your home. As Investopedia puts it:

“Curb-appeal projects make the property look good as soon as prospective buyers arrive. While these projects may not add a considerable amount of monetary value,they will help your home sell faster—and you can do a lot of the work yourself to save money and time.”

Revamping your home's exterior with a fresh coat of paint and power washing will create an amazing initial impression for potential buyers, helping your house to stand out from the crowd. Reach out to a real estate expert so that you can determine affordable projects you can accomplish around the property which will attract prospective buyers in your area.

Here's what we know:

Curb appeal is one of the key factors in attracting potential buyers to your property. It's important to make a good first impression - that’s why it’s essential to spruce up the exterior of your home. This will help draw people into seeing what you have to offer inside.

So, how can you boost the curb appeal of your home? Here are a few helpful tips:

- Change or update the front door. Replacing an old, worn-out door with a modern one can instantly change the look and feel of your entranceway.

- Add color. A pop of color on your front porch will help draw people's attention and create an inviting atmosphere. Consider painting the door or shutters, adding brightly-colored flowers to your landscaping, or hanging a cheerful wreath on the front door.

- Give your lawn some TLC. Keep your lawn mowed and tidy up any garden beds that have become overgrown with weeds. This can help make a big impression on potential buyers.

- Keep up with landscaping. Planting shrubs and flowers is an easy way to make your outdoor space look more inviting and well cared for. Additionally, be sure to trim any overgrowth so the view of your house isn’t blocked by trees or shrubs.

If you're feeling overwhelmed or just don't have the time, then it might be a good idea to hire a professional landscaper. A pro can help you select the right plants and flowers for your area, show you how to care for them, and give suggestions for other ways of enhancing the look of your property.

When it comes to selling real estate, making a great first impression is key. So, this spring take the time to spruce up your home's exterior and make it stand out from the competition! With expert guidance, you can boost your residence’s curb appeal in no time.

Every Upgrade is Unique in its Own Way

When deliberating what to do to your house before you put it up for sale, remember that these upgrades and repairs are not for yourself but rather for the potential buyers. Place higher priority on projects that will help get a speedy sale or garner more money over those which may be aesthetically pleasing to you as an owner.

If you’re unsure of specific improvements to make in order to increase the value of your home, consider working with an experienced real estate agent who can assist you in understanding which renovations bring value to your unique local market.

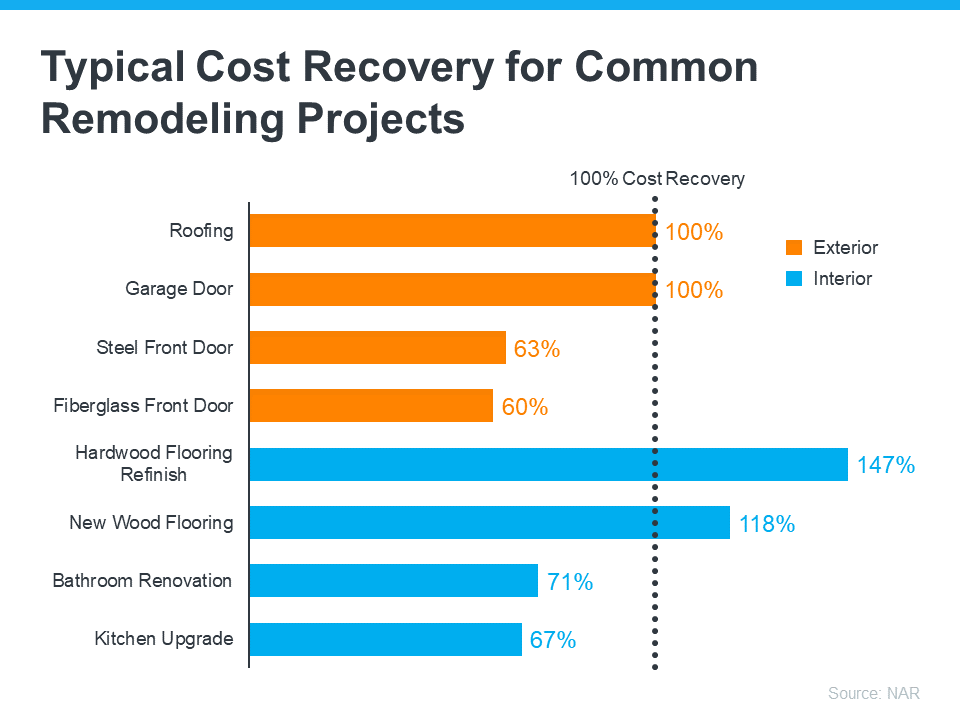

Homeowners can receive a substantial return on their investment when they make certain home improvements, according to the 2022 Remodeling Impact Report from the National Association of Realtors (NAR). Take a look at this graph below which highlights some of these popular projects and how much they yield:

Ensure you seek counsel from a reliable realtor in order to receive the finest advice on which renovations should be your priority. They are well-versed in recognizing what features potential buyers favor and also equipped with recent know-how of how to make sure your residence sells swiftly this upcoming season.

Take the time and money to make updates around your home which will attract prospective buyers and add value to your real estate investment. Working with a real estate expert can help you determine affordable projects that will stand out in your area and generate a higher return on your sale.

If you're planning to list your house on the market this spring, now is when action should be taken! Get in touch with me straight away so we can figure out which upgrades will yield the highest return. Don't miss out on a great opportunity - let's talk soon and get started.

2-24-2023

Are You Curious About the Current State of Home Prices

With spring in the air, home-buyers are eager to make sense of the conflicting reports about current housing prices. To help you get clarity around this buzzy topic and equip you with knowledge on today's real estate market, here is a breakdown of what homeowners need to know.

Despite differences in regional pricing, when it comes to national trends Nataliya Polkovnichenko - Supervisory Economist at the Federal Housing Finance Agency (FHFA) – has something to say:

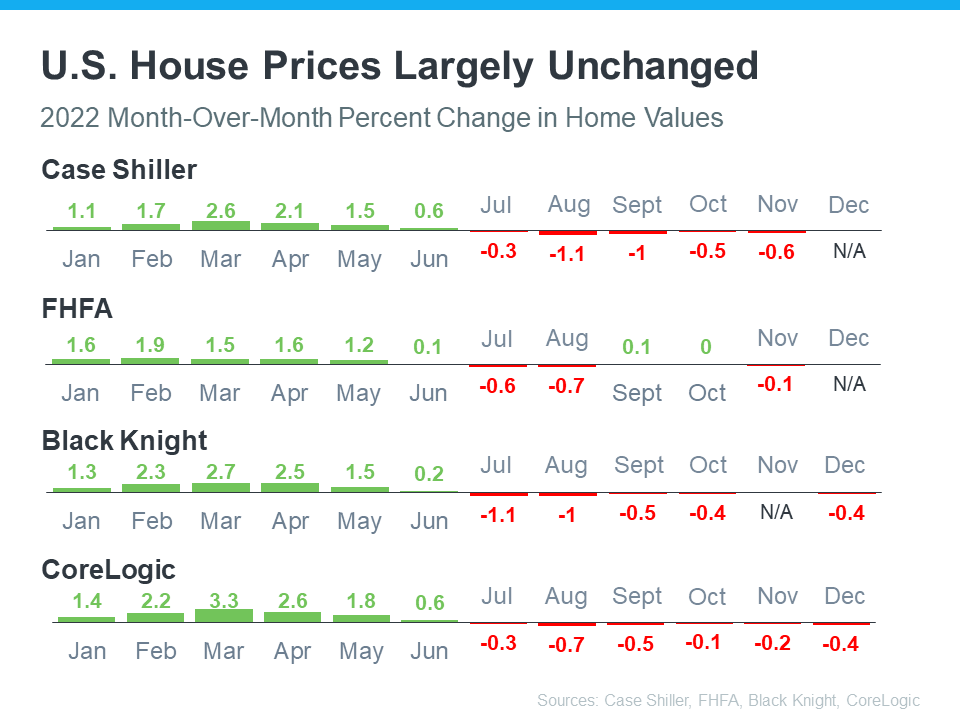

“U.S. house prices were largely unchanged in the last four months and remained near the peak levels reached over the summer of 2022. While higher mortgage rates have suppressed demand, low inventories of homes for sale have helped maintain relatively flat house prices.”

As seen in the chart provided, month-over-month fluctuations of home prices can be observed. The numbers also demonstrate that price depreciation peaked during August, and since then has been even gentler. To put it another way, current house costs are not falling hard anymore.

What Does This Opportunity Mean for You?

Even though you may be worried about the resilience of your home's value during these times, it is helpful to take into account how much property values grew in recent years. In comparison with that growth rate, any national declines we are seeing now will probably remain minimal. Selma Hepp, Chief Economist at CoreLogic expressed:

“. . . while prices continued to fall from November,the rate of decline was lower than that seen in the summer and still adds up to only a 3% cumulative drop in prices since last spring’s peak.”

As each local market has its own distinct dynamics, it's essential to tap into the expertise of a professional for up-to-date knowledge on housing costs in your region if you're making plans to move this spring. amiliarizing yourself with the current market conditions can help you make an informed decision as to how you are going to approach buying a house this year.

It is also beneficial to keep in mind that your living space may not only be a place for you right now, but it could be viewed as an investment for future years. The housing prices weare currently seeing could be a sign of stability in the future.

So, when considering purchasing a property this spring, don’t forget to factor in all of these elements for the best possible outcome. The key is being informed and prepared to make an educated decision about your purchase. With that knowledge, you can rest assured knowing youare making the right choice.

Final Verdict

Home prices in our market are ever-changing, so to make sure you're still on track for reaching your goals, let's connect today and discuss how it might affect you. The current state of home prices may be a great opportunity for you to take advantage of. Whether you're buying or selling, the right guidance is essential in making sure your real estate goals are achieved! Get in touch now and let's get started!

2-22-2023

Take the 100 Envelope Challenge and Save $50,000 for Your Down Payment

Are you dreaming of owning your own home, but don't think it's possible with the down payment? Think again! With our 100 envelope savings challenge, you can save up to $50,000 in just 100 weeks.

It may seem like a daunting task at first, but with our easy tips and tricks it is totally doable. Imagine being able to walk into your dream home knowing that you had saved for most of the down payment already. You could finally become a homeowner without having to worry about where the down payment will come from.

Set a Goal

Setting a goal is a great way to help motivate you and stay on track with saving for your down payment. I suggest that you decide how much money you want to save, and then create a plan as to when you want to reach that amount, such as in 100 weeks. This will give you clear parameters around what needs to be achieved, so that you can track your progress regularly against your goals and make adjustments if necessary.

Start Saving

When you're ready to jump into the housing market, saving money for a down payment is key. It may seem like it takes forever, but I can assure you that starting to save now will get you closer and closer to your down payment goal. Setting aside just a small amount each week – no matter what the amount – and placing it in an envelope or savings account helps turn that dream of yours into a reality. Whether it's $10 or $100 per week, any amount you can commit to saving will get you closer and closer to your down payment goal.

Double Down

When it comes to down payments, investing in yourself is always a great idea. Take on the challenge and double down on the amount you save each week; if you can afford it, you will be that much closer to achieving your down payment goal. A down payment can seem intimidating at first but when you prioritize it and make regular contributions, it quickly adds up and brings you that much closer to getting the keys in your hand for homeownership. With only a few months of double downs, you too can reap the benefits of home ownership.

Track Your Progress

As realtors, we understand the importance of having a down payment saved up before making the big jump to homeownership. That's why we always encourage our clients to track their progress in reaching that down payment goal. With tracking software like spreadsheets and budgeting apps, you can easily keep tabs on how close - or how far - you are from saving the money for your down payment. That way, you'll be able to adjust your savings goals as needed and stay up to date on how well you've already done.

Hold Yourself Accountable

You’ve got down payment goals and the dream of homeownership within reach; now it’s time to ensure you stay the course. Working with someone who can hold you accountable will help make sure you stay on track and are consistently achieving your down payment goals. Find somebody who wants to keep you honest, motivated, and focused on your down payment objectives! Doing so will eventually pay off when you can finally take ownership of that dream home.

Taking the 100 envelope challenge just might be the key to unlocking your dream of owning a home. With our tips and tricks, it's not as daunting as it may seem. Start saving today and you'll be able to walk into your dream home with down payment in hand.

So what are you waiting for? Download our 100 envelope challenge now and start saving towards your down payment today!

2-20-2023

Are You Thinking About Investing in a Newly Constructed Home

If you’re in the market for a new house, don't limit yourself to pre-owned properties. There are few homes currently available on the market; however, why not give newly built residences some consideration? You could potentially snag your dream home and get more bang for your buck!

Newly built homes come with the advantage of having everything up to code and in top shape. This means you can be certain that your home is up to safety standards and needs no major renovations. Plus, new construction often includes modern amenities like modified insulation, updated electrical systems, spanking new appliances, and more.

Plus, you can customize the property to your liking. Many builders create models that you can choose from and they’ll even make slight modifications or upgrades depending on what you wanted. For example, if you want a specific type of flooring or kitchen countertops, it's likely something they could accommodate.

On top of all this, newly built homes come with warranties that protect you should any of the construction or appliances malfunction. It’s a great way to get peace of mind and ensures that your money is well spent.

If you’re looking for a home, consider investing in newly built properties. You could be rewarded with more amenities, a safe and up-to-date structure, and plenty of warranties. Don’t overlook the advantages that come with newly constructed homes!

The construction of new homes is on a steady rise

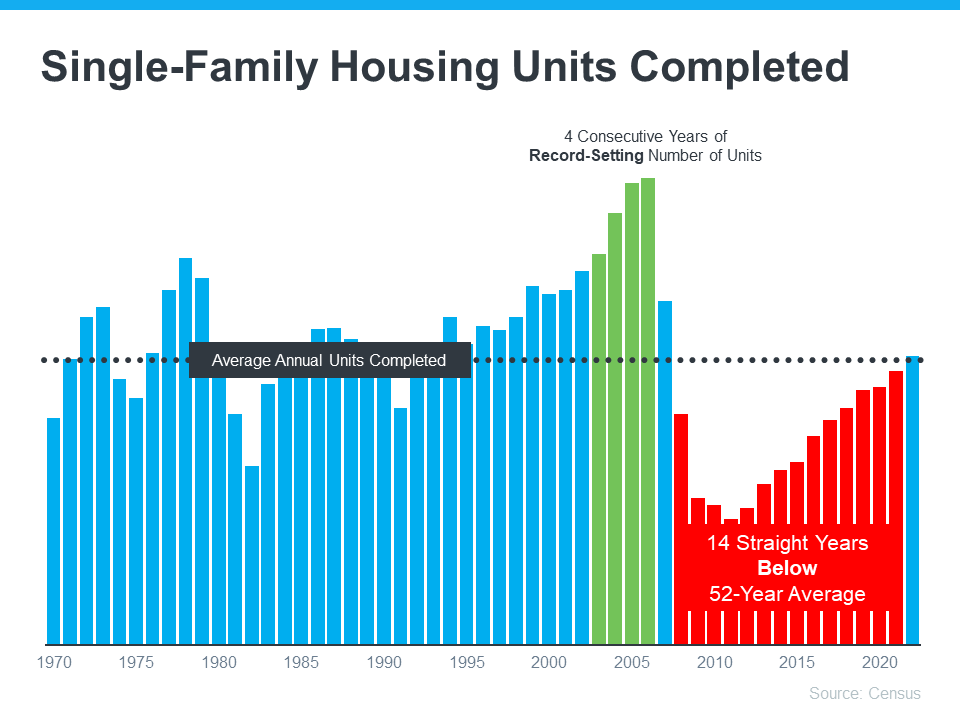

Despite the current surge in housing offerings compared to last year, there is still an unusually low number of homes available on the market. One possible cause for this can be attributed to years of inadequate construction--not meeting homeowner demand with sufficient fresh builds.

This graph starkly illustrates the limited production of newly constructed homes for the past 14 years. But there is an indicator that buyers can be optimistic about: a steady incline in newly built dwellings each year, as per Chief Economist at First American, Mark Fleming. Therefore, this projection bodes well for those searching to purchase a home!

“While existing-home inventory remains limited, the silver lining for home buyers is that new-home inventory is on the rise, and a new home at the right price is a pretty good substitute.”

Taking Advantage of Builder Incentives Can Give You an Instant Boost!

As the number of new homes for sale continues to swell, builders are reducing their construction rate until they get rid of more of their current stock. Logan Mohtashami, Lead Analyst at HousingWire, remarked:

“The builders have to work off the backlog of homes, but instead of 3%-4% mortgage rates, they’re dealing with 6% plus mortgage rates, which means they have to provide many incentives to make sure those homes sell.”

To make their new homes more accessible, many builders are now offering buyers attractive incentives. According to Fleming:

“The National Association of Home Builders reported that nearly two-thirds of builders were offering incentives, including mortgage rate buydowns, paying points for buyers and price reductions, which could entice potential home buyers.”

If a builder is willing to pay for you to have a lower mortgage rate, it could be the game changer of your financial future. Ksenia Potapov, economist at First American states:

“A one percentage-point decline in mortgage rates has the same impact on affordability as an 11 percent decline in house prices.”

Are You Ready to Invest in a Brand-New Home?

When it comes to selecting the perfect dwelling, enlisting a reputable realtor is indispensable: they can assist you in comparing and contrasting all available options. Moreover, realtors are informed of all houses on the market - plus any special benefits that builders might be offering - so you don't miss out on great opportunities.

Fully built homes offer numerous rewards: you have the opportunity to immediately move in and customize it to your liking with up-to-date features, appliances and warranties. With builders now providing attractive incentives, there has never been a better time to invest in a brand-new home!

So if you’re in the market for a new home, consider taking advantage of newly constructed dwellings and all the benefits that come with them. With the right realtor and some savvy shopping, you could find yourself living in your dream home sooner than you think!

Even though there aren’t a lot of homes for sale today, new home inventory is on the rise, and many builders are offering incentives. Let’s connect so I can help you weigh the pros and cons of shopping for a new home versus an existing one.

2-17-2023

Important Things To Consider When It Comes to Closing Costs

Before you take the leap and purchase a home, it is essential to plan for all costs that may arise. While many are aware of how much they need to save for a down payment, few understand what closing expenses will be due at the conclusion of their transaction. To prevent any surprise fees when finalizing your property purchase, familiarize yourself with both what these charges entail and how much should be set aside in advance.

Closing costs can be split into two categories: those that are paid by the buyer, and those which are paid by the seller. Buyer costs range from pre-paid items such as homeowners insurance and property taxes to lender fees for loan origination and appraisals. These costs typically amount to between 2-5% of your home’s purchase price. Seller expenses, on the other hand, include any commissions due to their real estate agent or broker and may even cover some of the buyer’s closing expenses.

In addition to understanding what is included in closing costs, it is important to know when these payments need to be made. Generally speaking, buyers should expect a breakdown of all estimated closing expenses once they are under contract and have obtained a loan. At this time, borrowers can begin to save the necessary funds in preparation for closing. Once they are ready to sign all documents, buyers will be required to pay the due fees before ownership is transferred.

By taking the time to research and budget ahead of time, you can ensure that your home purchase process runs smoothly. Understanding what closing costs entail and how much needs to be saved will help prevent any unexpected surprises at the close of escrow. With these tips in mind, you can focus on finding the perfect property without worrying about financial hiccups along the way.

Delving into Closing Costs - What Do You Need to Know?

To many individuals' surprise, closing costs exist and are often unknown. Bankrate sheds light on the matter:

“Closing costs are the fees and expenses you must pay before becoming the legal owner of a house, condo or townhome . . . Closing costs vary depending on the purchase price of the home and how it’s being financed . . .”

To put it succinctly, your closing costs encompass the expenses and payments related to your transaction. Depending on where you live or what type of situation you are in, Freddie Mac states that these fees may differ; however, typically they include:

- Government recording costs

- Appraisal fees

- Credit report fees

- Lender origination fees

- Title services

- Tax service fees

- Survey fees

- Attorney fees

- Underwriting Fees

How Much Should You Allocate for Closing Fees?

It's critical not only to comprehend what closing costs consist of, but also recognize how much you'll need to allocate for them. According to the Freddie Mac article cited above, typically it is 2-5% of your total home purchase price that needs funding for these fees. With this knowledge in mind, here are tips on how you can anticipate what expenses will be necessary when covering your closing costs.

If you've found the home of your dreams, and it costs a median rate of $366,900, then don't forget to factor in closing fees that could range from an estimated 2-5% with Freddie Mac. This means you would be looking at expenses between approximately $7,500 - $18,500.

Remember, if you are looking for a home that is more or less expensive than this price range, your closing costs will subsequently fluctuate.

Now that you have an understanding of what closing costs encompass, and a general range of what to expect for your particular purchase price, you are one step closer to becoming a homeowner. Make sure you factor in the additional expenses when preparing your budget: having this information up front can help make the home-buying process much smoother.

How Can You Guarantee That You're Ready to Seal the Deal When Closing Time Comes?

Freddie Mac offers invaluable advice for prospective homebuyers, urging them to:

“As you start your homebuying journey, take the time to get a sense of all costs involved – from your down payment to closing costs.”

Looking to purchase a home? Work with an expert team of real estate professionals who can help you understand exactly how much your closing costs will be. Your agent can link you up with the best lender, and then all together they'll answer any questions or queries that arise throughout this exciting process.

Having the right team on your side can make all the difference. Make sure you have an understanding of these closing costs in advance to ensure a successful, stress-free closing day!

Preparing for closing costs is one of the most crucial steps in the home-buying process. So, it's critical that you have a reliable plan in place prior to signing any documents. Rest assured, I am here to guide and support you throughout this entire journey so that your experience remains stress-free! Let’s get together soon so we can help bring clarity and confidence into your dream purchase today.

2-15-2023

Dont fear a housing market crash - heres why

With the increasing media coverage of changes in the housing market, it's no surprise that 67% of Americans are expecting a crash to occur within three years. Fortunately, recent evidence indicates this won't be anything like when homes plummeted in value 2008; today's market is far more stable and secure.

Back Then, Mortgage Standards Were Less Strict

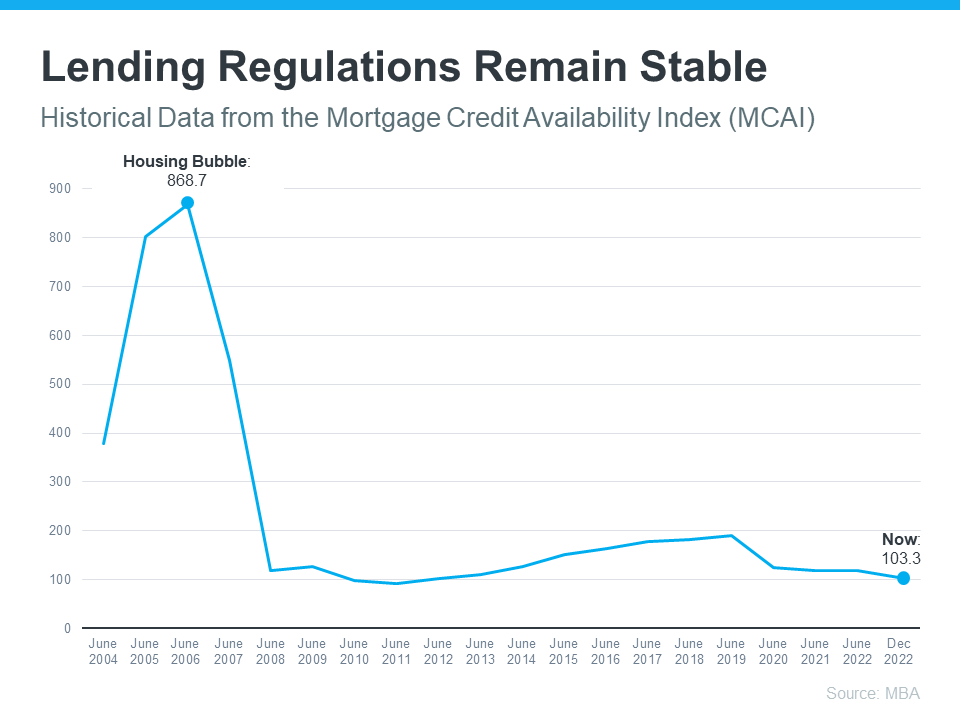

In the years prior to the housing crisis, banks were deliberately driving up demand by weakening their lending criteria and allowing virtually anyone to qualify for a loan or mortgage. This made it far simpler than it is today for people to own homes.

Consequently, banks and other lending entities assumed a far greater risk when it came to both borrowers and the type of mortgages they provided. That caused an upsurge in defaults, foreclosures, and plummeting property values. Nowadays though, standards for mortgage seekers are much stricter than before due to improved oversight from lenders.

The graph below, utilizing data from the Mortgage Bankers Association (MBA), illustrates this story through its numbers: a higher number indicates that it is easier to get a mortgage; conversely, if the figure is low, securing one becomes more challenging.

This graph poignantly demonstrates how regulations have changed since the crash, allowing lenders to remain more responsible in their provision of credit. This has resulted in a significantly lower risk of foreclosures than what was seen during the previous crisis.

Foreclosure Volume Has Declined a Lot Since the Crash

The number of homeowners facing foreclosure took a sharp decline when the housing bubble burst, and since then has remained substantially lower. This is due to more qualified buyers today who are less likely to default on their loans. The chart below, composed with data from ATTOM, displays this significant contrast between now and last time:

Even with a slight surge in foreclosures, the overall number remains quite low. Furthermore, experts contend that foreclosures will not skyrocket as they did following 2008's market crash. Bill McBride of Calculated Risk elucidated how this played out before and why it is highly improbable to ever happen again, emphasizing the price of homes at the time.

“The bottom line is there will be an increase in foreclosures over the next year (from record level lows), butthere will not be a huge wave of distressed sales as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.”

The Supply of Homes for Sale Today Is More Limited

Looking back, it was clear that the housing crisis caused an oversaturation of homes on the market. These were mainly foreclosures and short sales which resulted in a dramatic decrease in prices. Since early this year, there has been an increase in supply but overall inventory is still scarce given years of underbuilding properties.

The graph below, based on data provided by the National Association of Realtors (NAR), illustrates how unsold inventory today compares to that during a crash. At present, there is only 2.7-months’ supply available at the current sales rate--significantly lower than it was before--so despite some possibly overvalued markets potentially experiencing slight declines in prices, this time around we should be spared from an extensive and dramatic fall like last time.

What are the Benefits of Homeownership

For many people, the benefits of homeownership far outweight the disadvantages. There are numerous advantages to owning your own home, including building equity, having a place to call your own, and creating a stable living environment for yourself and your family. However, it's important to remember that with any big purchase comes responsibility. As a homeowner, you'll be responsible for maintaining your home and paying property taxes and insurance. But if you're prepared for the challenges that come with homeownership, you can enjoy all the advantages that come long with it. Let's take a closer look at some of the top benefits of homeownership.

The Feeling of Ownership

When you own your own home, you can do whatever you want to it. You can paint the walls, put in new floors, or knock out a wall if you really want to. It's your house and no one can tell you what to do with it.

Owning a home provides peace of mind that you can make whatever changes you’d like in order to truly make it your own. Whether you want to paint the walls football colors, create an open floor plan by knocking down a wall or two, put in some hardwood floors for a more contemporary style, the possibilities are endless when it comes to making your house yours. In other words, when you own a home, you have the freedom and control to do whatever you want with it without anyone else telling you otherwise. This is why so many people crave owning their own homes – nothing quite compares to having your very own castle and being able to customize it exactly how you’d like!

Pride of Ownership

There’s a certain pride that comes with owning your own home. You worked hard to get where you are and now you get to enjoy the fruits of your labor. Seeing your name on the deed is a great feeling.

Buying a home is one of the signature moments in life. You've finally reached a point where you have the wherewithal to put your money and energy into something that will not only benefit you today, but also protect you in the future. There's no better feeling than signing the deed to your new home and holding it up proudly, recognizing all of your hard work has paid off. Everyone should experience this once-in-a-lifetime moment for themselves, because there's no greater pride than owning your own place and knowing that it's yours.

Tax Breaks

As a homeowner, you get some great tax breaks that renters don’t have access to. You can deduct things like mortgage interest and property taxes from your income taxes, which can save you a lot of money at tax time.

Owning a home can be a great asset come tax season! Being wise with your money should mean more than simply trying to go green and save the environment - it should also involve making sure you're taking advantage of any and all tax benefits. As a homeowner, you have access to an array of deductions that renters simply don't. This means you can put your mortgage interest and property taxes right back in your pocket, where they belong! Whether buying or renting, make sure you careful research each and every route so you understand the possible savings involved.

Build Equity

Every time you make a mortgage payment, you’re building equity in your home. Equity is the portion of your home that you actually own outright—it’s like savings account that grows over time as you pay down your mortgage balance. So not only does homeownership give you a place to live, but it also helps you build wealth over time.

As a homeowner, you have the unique opportunity to gain equity in your home as time passes. Every payment that you make on your mortgage is one step closer to building up this vital savings account that many people use for retirement or large investments. Not only does Sustainably increasing your equity through mortgage payments give you a place to call home, but it also provides long term stability and allows you to leverage the value of owning real estate. Making sure that you’re staying ahead of the curve when it comes to financial health is incredibly important and by taking advantage of all the resources available, homeownership gives you an excellent opportunity for financial freedom in the future.

Forced Savings Plan

A mortgage is basically a forced savings plan—each month, part of your payment goes towards paying off the principal balance of your loan (which is like saving), while the other part goes towards interest (which isn’t). So even if saving isn’t something that comes naturally to you, owning a home forcesyou into it whether you like it or not!

Making a mortgage payment every month is one of the best forced savings plans out there. Part of each payment goes towards paying off the principal balance of your loan, while the other part covers interest. This means that even if saving money isn't something that comes naturally to you, owning a home can provide an excellent opportunity to build a nest egg and establish financial security for the future. By taking advantage of all the resources available, you can start to make progress towards owning your own home in no time.

Stability

There’s nothing like owning your own home for providing peace of mind. Once you purchase a home, you don’t have to worry about moving if your landlord decides to raise the rent or sells the property. You can stay in your home for as long as you want, which gives you a great sense of stability and security.

Owning your own home provides incredible peace of mind and stability that renting just can't match. When you own your own home, you no longer have to worry about your landlord raising the rent or selling the property. You can plant your feet and stay in one place for as long as you want, while also feeling secure that your home is safe from changing market forces. By investing in a home of your own, you take control of your financial future and give yourself the chance to reap the rewards of homeownership for generations to come.

Home Improvements Add Value

As a homeowner, you can customize your house to make it uniquely yours. This is one of the greatest advantages of owning over renting—you get to choose what goes into your home and when. And if you do it right, any improvements or additions that you make will increase the value of your home, which is like money in the bank!

Making improvements to your home is a great way to add value, and it's something that you can only do when you own. From doing basic updates like painting or replacing flooring, to larger projects such as remodeling a kitchen or adding an outdoor living space, there are plenty of options for increasing the value of your home. Not only that, but it's also a great way to make your house feel like home!

Sense of Community

Buying a home also gives you the opportunity to become part of a community. Whether it’s joining a local homeowners association or participating in events like block parties or neighborhood watch, owning your own home allows you to be an active member of your community. And living in close proximity with other people is great for building relationships and friendships that can last a lifetime.

In summary, whether you're renting or buying, it pays to carefully research all your options and make sure that you understand the financial implications of each. Owning a home provides many important benefits like forced savings, tax deductions, equity building, and stability that renters simply don't have access to. By taking advantage of all the resources available, homeownership can help you achieve financial freedom in the long run. So if you're considering buying a home, make sure to weigh all the pros and cons and make an informed decision that best fits your personal financial goals.

Owning a home is a major investment and the rewards are great, but it's important to understand the financial implications before taking the plunge. Make sure to carefully research all your options and weigh the pros and cons of each. With proper planning, homeownership can be an excellent way to build up equity, establish a forced savings plan, get tax deductions, and gain peace of mind through stability. With all these benefits in tow, you can start to make progress towards owning your own home in no time.

By taking the time to evaluate all the resources available, you can start to build a strong foundation for your financial future and achieve true financial freedom and security through homeownership. With careful planning and research, you'll be on your way to becoming a homeowner in no time. Invest in your future and make the most of homeownership today!

Owning a home doesn't just provide financial security in the present, it also sets you up for success in the future. With all the resources available to help you plan and prepare for home ownership, you can confidently work towards achieving financial freedom and security through homeownership. So if you're ready to make a major investment in your future, consider all the benefits of homeownership and start planning out your journey today!

Take the first step toward your dream of home ownership today by reaching out to us at 720-463-0002. We are here and eager to begin helping you plan for a successful future!

2-8-2023

Feb 2023 Newsletter

To ensure you are truly content when your retirement arrives, it is crucial to take proactive steps now. In this month's edition of Service For Life!® Free consumer newsletter, discover how you can make wise financial decisions that will maximize the joy in your life after retirement.

Plus, you'll gain insight on how to select a probiotic and why this is important for your family's health, get advice from the pros on creating a family media plan that works for everyone in regards to screen-time monitoring and discover insider tricks on achieving streak-free windows. And if that wasn't enough, we even include fun facts plus an exciting trivia challenge.

Ultimately, I'm here if you need me for anything. Furthermore, should a friend or family member of yours require the expertise and care of an experienced real estate agent while buying/selling property, please do not hesitate to contact me.

I am so grateful for your friendship and the referrals you have sent my way. May this issue bring you joy!

Warmest regards,

Bill Watson

President / Managing Broker

Your Home Sold Guaranteed Realty - The Watson Group

6155 S Main Street, Suite 270

Aurora, CO 80016

720-463-0002

bill@watsonrg.com

www.yourhomesoldguaranteedrealtyco.com

P.S. If you come across anyone discussing real estate, kindly inform them about my complimentary consumer information. Doing so will go a long way in ensuring that they are as informed and prepared for their investments as possible!

If you know of anyone looking to move in the next six months, tell them about my complimentary consumer report “Elevate Your Home's Look Without Spending A Fortune!.” This helpful guide includes a checklist of cost-effective methods to make buyers instantly interested in your home. To get a copy for someone special, just call me at 720-463-0002 and I'll be glad to help!

SELL YOUR HOME FAST and for TOP DOLLAR! Get this FREE Report that

Reveals 27 Tips to Give You the Competitive Edge! www.Our27Tips.com

Most Important Assets for a Happy Retirement

Retirement may seem a long time away for many, but it does come around more quickly than you might think. And if you truly want to have a happy retirement, there is a checklist of items that you should start considering as early as possible (and they’re not only financial):

- Preparation: It goes without saying that you need to save for retirement, but are you aware of how to do it smartly? Will you invest your assets? Hire an investment strategist? Hedge your bets across a diverse portfolio? These are all important questions to consider when planning for retirement. Be sure to speak to a professional (and get a second opinion) to have a short, medium, and long-term strategy for your retirement.

- Headspace: There’s a lot to be said for mental work. A strategic mindset is important, whether you’re preparing for the reality of slowing down or to save large chunks of money that you could use on a home improvement project. For instance, knowing that you want to be comfortable in retirement means you may have to pinch pennies. It also means that you must do the mental work of preparing yourself for the volatility of the stock market, should you choose to make the most of your savings. The stock market, especially when it comes to long-term investments, can be an emotional rollercoaster. That’s why it’s important to consider the amount of risk you are prepared to take when you watch the market go up and down with your savings. It isn’t for the faint of heart, which is why you need to have the right mindset and knowledge that investing is a long game.

- Having a life plan: What are you going to do with your extra time? Some people like to take up a new hobby, others like to travel, and some retirees even take up part-time work to keep them involved and stimulated. Whatever you do, ensure that retirement is a time for joy, relaxation, and spending time doing things and with people that matter to you. It will make some of the financial sacrifices more rewarding.

Subscribe to Our Newsletter

HIGHLINE EAST AT DAYTON TRIANGLE

The Highline East at Dayton Triangle community by Montano Homes offers brand new paired homes that are ideal for people looking to move into a vibrant and dynamic neighborhood. With 3 bedrooms, 3.5 bathrooms, private yards and designer selected finishes combined with their affordable prices starting from the mid $600s, these Colorado Contemporary townhomes make this an incredible place to call home! Plus it's located close to Downtown Denver, DTC shopping centers and parks—what more could you want?

See What Our Amazing Fans Have to Say

Visit www.OurAmazingFans.com

Probiotics: How & Why to Choose One

You may often hear suggestions to take probiotics, but what exactly are they and why should you? The gut–otherwise known as the digestive tract in your body–is a remarkable system leading from the mouth all the way to your bottom. Contained within the gut are bacteria. Most bacteria are good for you and can support a healthy digestive system by providing a host of benefits, like boosting immunity, producing brain chemicals like serotonin, and even anti-aging benefits. However, some bacteria can cause disease, obesity, diabetes, and Alzheimer’s.

That’s why people take probiotics–a friendly type of bacteria or other living microorganism–toencourage the correct balance of bacteria in the gut. Probiotics may also help with digestive problems like irritable bowel syndrome, weight loss, skin health, and can positively impact neurological disorders.

So, how do you find the right probiotic?

- Two of the most common types are Lactobacillus and Bifidobacterium, but there are a host of others. Each strain of bacteria is said to support certain health conditions, too. Check with your doctor on a recommended strain for you or do some online research to see which strains are considered best for your condition.

- Ensure the probiotic you choose is made in the United States by a reputable company that does third-party testing – a sign of higher quality supplements. Brands like Klaire Labs, Pure Encapsulations, and Designs For Health are usually doctor- or nutritionist-recommended, which is a sign of their efficacy and quality. You can buy many of these brands directly from the manufacturer online, which is the best way to ensure they are genuine and not a knock-off.

- Most experts suggest choosing a probiotic with at least 1 billion colony-forming units (CFUs), but check with your doctor to see what they recommend for you.

Find out the value of your home by answering a few simple questions. By providing your address and home description, the system will produce a complete market analysis through a search for similar homes sold and listed in your area.

Kids and Media

Technology has advanced so quickly that there are electronic devices all around us. Kids have access to countless video games, can watch hundreds of channels of TV, lots of videos, and they can even interact with others across the world on social media and other messaging apps. That can be a frightening prospect when your child could be interacting with strangers.

It can be hard as a parent to set boundaries around screen time and interactions, and your child may get resentful if their access to technology is restricted. Another approach could include setting limits on the apps themselves and working with the family collaboratively on a family media plan. Some ideas include:

- Create a family media plan that the family can use to make a list of media priorities. Visithealthychildren.organd search for “media plan.”

- Check out Common Sense Media (commonsensemedia.org) for reviews of movies, TV shows, games, podcasts, books, and apps and their appropriate viewing age.

- TV Ratings and the V-Chip – All TV sets since 1999 allow you to block TV and films based on rating. Check your TV’s instruction manual to see how to do it.

AT MURPHY CREEK

Experience the perfect home at Montano Homes' Elevations at Murphy Creek. This central master-planned community grants easy access to DIA, shopping, and gourmet dining near Southlands Mall. Not only that but it is situated next to one of Colorado's finest golf courses - a links style course! With its 3 bedroom Colorado Contemporary Paired homes, you can definitely call this place your own little paradise. Welcome home to Elevations at Murphy Creek by Montano Homes!

Find out how this changing market has affected your home value! Your home may be worth more than you think.

Visit www.AccurateHousePrice.com or Call Us at720-463-0002.

This is a FREE service with NO OBLIGATION to list.

Clean Your Windows the Right Way

Everyone has windows, and it’s always a struggle to keep them spot- and streak-free. Try this checklist to keep your panes perfect:

- Place towels on the floor and a smaller on the windowsill to collect dirt and any water.

- Clean curtains and blinds first so you don’t have dusty curtains/blinds touching your clean windows!

- Label each screen before removing it and setting aside.

- Use a large duster or whisk broom to clean around the window frame.

- Next, clean the inside of the window with a damp cloth before applying a window cleaner.

- Use a window cleaner and spray each section as you go, using an S motion, avoiding spraying the whole window at once because it might dry before you can wipe. Clean the window with a microfiber cloth or other lint-free cloth.

- Dry with another cloth, a dry part of your first cloth, or a squeegee.

- Believe it or not, the outside is easier, because you can use a garden hose! Be sure to close all windows first and dust off debris. Rinse with the hose, then dry with a squeegee or microfiber cloth. For windows above the ground floor use a telescoping pole with a cloth attached for the cleaning and drying.

Studies have shown your income and wealth are directly related to the size and depth of your vocabulary. Here is this month's word.

Greenwash(green-wash) verb

Meaning:To misleadingly advertise something (a product/service/item) as more eco-friendly than it is.

Sample Sentence:“The new car by that manufacturer has actually been greenwashed.”

Subscribe to Our Newsletter

Not Ready to Sell? Text your address to 720-605-1268 to find out what your home will sell for today. You will not receive a phone call, just a text!

Before You Wait for 3& Mortgage Rates, Consider This

In an attempt to manage inflation, the Federal Reserve made some adjustments last year which caused mortgage rates to skyrocket from their 2021 historic lows of around 7% in October. Unfortunately, this monumental leap had a detrimental impact on prospective buyers' purchasing power, leading several people to put. . .

5 Tips for Supporting a Friend Through Surgery

- Offer help you know you can follow through on: that might be organizing meals, picking up groceries, or providing transportation to and from the hospital

- Depending on the type of surgery, suggest that they have everyday items close by, or at counter height.

- Offer to walk their dog or send them vouchers to a dog-walking services, like Rover.

- Offer to make a batch of pre-cooked meals for a week, like casseroles or crock-pot dinners.

- Help them organize paperwork, like an Advance Care Directive, medication lists, and post-operative care instructions.

A Heartfelt Message to our Special Clients and Friends . . .

It is our pleasure to extend a warm welcome to all of the new clients we have had the honor of working with recently, and also offer special thanks to those who referred them. Our business would not be where it is today without your help!

Recently Sold Properties

by The Watson Group

Blackstone

Sold for $1,425,000!

Murphy Creek

Sold for $665,000!

Cross Creek

Sold for $449,999!

Mesa

Sold for $500,000!

Rowley Downs

Sold for $621,900!

Cottonwood

Sold for $501,400!

Real Estate Corner . . .

Q:What are some mistakes I should avoid when investing in real estate?

A:Even smart investors make mistakes. Here are three common mistakes and what you should do instead:

- Not Doing Your Homework. Evaluate your financial situation and understand the right numbers to calculate. Learn the basics about cash flow, appreciation, and loan amortization.

- Not finding the right property. Do a thorough search, including “off MLS” deals and best buys, to find the right property for you. Work with a REALTOR®who is an Investor Specialist. He or she can help find a good investment property.

- Failing to get a professional inspection. You need to know if there have been problems with the property and that they’ve been properly addressed.

To learn more about owning investment property, call and ask for my Free Consumer Report called“Learn 8 Critical Strategies to Help Smart Investors Avoid Costly Mistakes.”I’ll be glad to send a copy right to you.

Do you have a real estate question you want answered? Feel free to call me at720-463-0002. Perhaps I'll feaure your question in my next issue!

Want to Win a $25 Starbucks Gift Card?

Last month's trivia question answer.

What modern technological term has etymological roots in a historic Viking leader?

(a) blockchain (b) serif (c) leading (d) bluetooth

The answer is (d) bluetooth. King Harald Gormsson was a Danish King with one blue-gray tooth, so he was knows as "King Harald Bluetooth." The founders of Bluetooth technology used the name because it was designed to connect devices, echoing King Harald's uniting of Denmark and Norway in the 10th century.

Now for this month's trivia question!

What famous female singer recently played a 200-year-old antique flute at the Library of Congress?

(a) Pink (b) Lizzo (c) Beyonce (d) Madonna

Call Me at 720-463-0002 or Email Me at bill@watsonrg.com

and You Could Be One of My Next Winners!

2-6-2023

CATEGORIES: Newsletter

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans