Our Blog

Recent:

Are You Curious About How Much You Need To Set Aside For a Down Payment

As you prepare to purchase your first home, one of the foremost expenses on your mind is likely the down payment. Don't let a misunderstanding about how much you need to save deter you from this exciting milestone in life; it's easier than what some may think!

Remember That 20% May Not Always be the Norm for a Down Payment

Freddie Mac explains:

“. . . nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home.This myth remains one of the largest perceived barriers to achieving homeownership.”

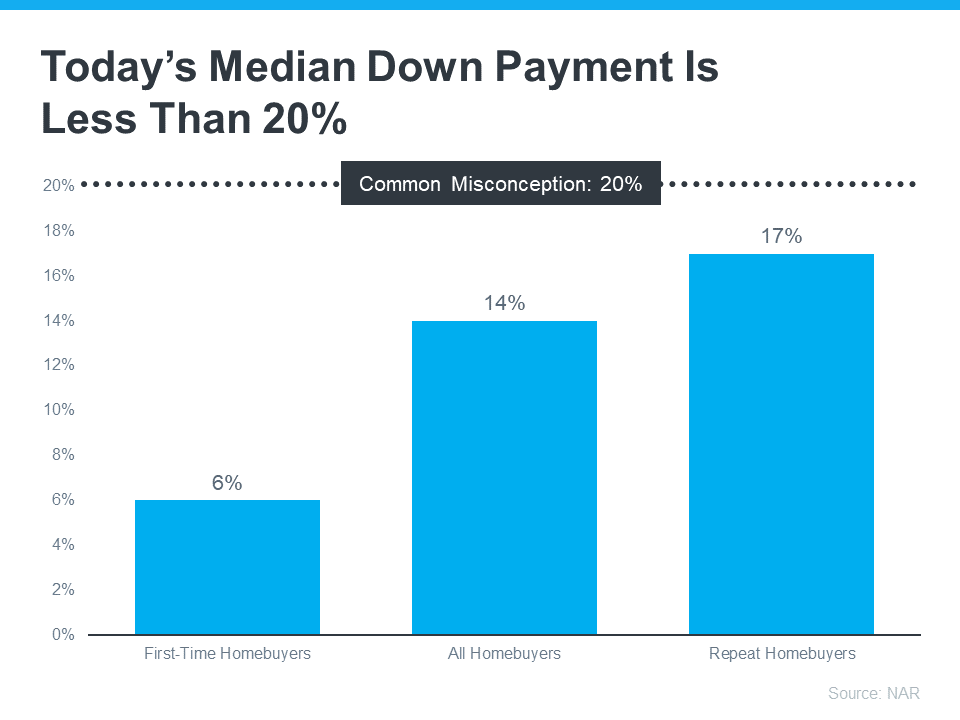

You don't have to put 20% down when taking out a loan, so you may be closer to purchasing the home of your dreams than you think. According to the National Association of Realtors (NAR), since 2005, putting more than 20% as a down payment has been uncommon and today's median is only 14%. It's even lower for first-time buyers at 6%, as seen in the graph below:

Learn about options that can help you toward your goals.

If you're still having difficulty saving for a down payment, remember that assistance is always available. A real estate expert and competent lender can demonstrate solutions to aid in accomplishing your desired milestone. The latest Homeownership Program Index from Down Payment Resource reveals there are more than 2,000 homebuyer programs in the United States designed mainly to assist with down payments. So don't hesitate to take advantage of all the help out there!

Subscribe to Our Newsletter

An FHA loan may require as little as 3.5% down, and VA or USDA loans could even be zero-down for those who are eligible! Don't miss out on these incredible opportunities to finance your dream home with minimal upfront costs.

Do your research and explore all of the available options. If you're searching for assistance with a down payment, Down Payment Resource has reliable information to help guide you. Afterwards, join forces with an experienced lender to identify what you qualify for on your home-buying journey!

Saving for a down payment on your first home doesn't have to be an intimidating process. You may not need 20% of the total cost, as many believe; in fact, the median is only 14%. There are also plenty of resources out there that can help you with financing and down payments, such as FHA loans which require 3.5%, VA or USDA loans at 0%, and more than 2,000 homebuyer programs available across America. Do your research and consult reliable sources like Down Payment Resource before enlisting the help of an experienced lender to identify what options you qualify for on your journey to homeownership!

1-4-2023

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans