Our Blog

Recent:

Foreclosure Trends 2023: Setting the Record Straight

Recent headlines on the uptick in foreclosures might have caught your eye, potentially igniting concerns about the stability of today’s housing market. However, looking beyond the surface level of these headlines and understanding the broader context is crucial to discern the true state of affairs.

Decoding The Numbers: A Comprehensive View

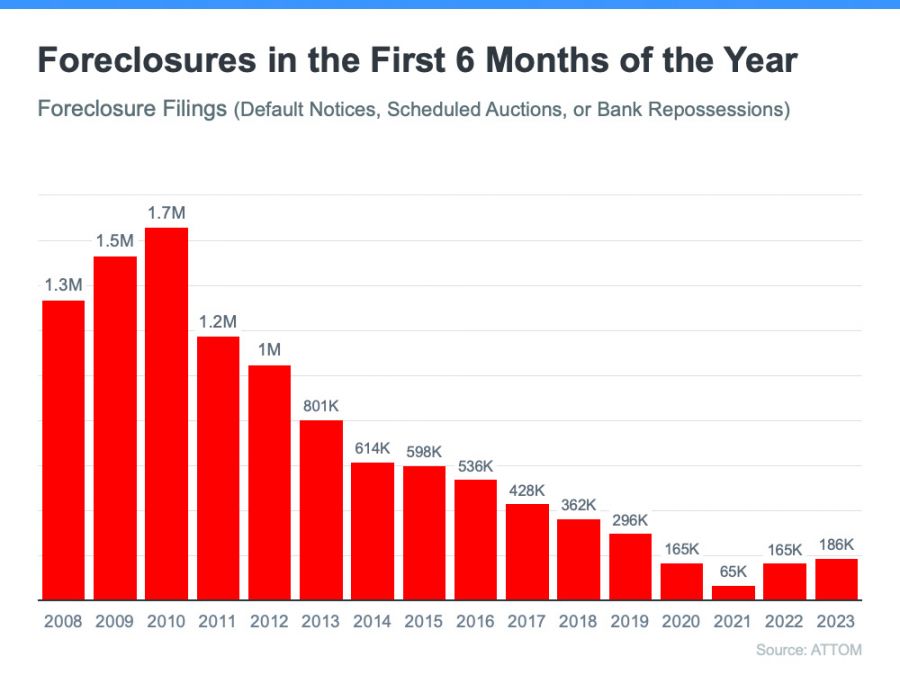

Recent data from ATTOM, a reputable property data aggregator, indicates a 2% rise in foreclosure filings from the previous quarter and an 8% increase year over year. At a glance, such figures might sound alarming. Yet, when set against a backdrop of historical data and other economic indicators, the story told is markedly different and far less concerning.

Today’s Foreclosure Landscape vs. The 2008 Crisis

Foreclosure numbers have recently been at historical lows. Significant contributors to this decline include the forbearance program and other homeowner relief initiatives implemented in 2020 and 2021. These interventions played a pivotal role, helping countless homeowners weather the economic challenges and retain their homes. Additionally, with appreciating home values, many homeowners could cash in on their home equity, sidestepping foreclosure altogether. It's anticipated that equity will remain a protective barrier against surges in foreclosure rates.

Post-moratorium, an uptick in foreclosures was anticipated. However, Clare Trapasso, the Executive News Editor at Realtor.com, offers an enlightening perspective:

“The rise in foreclosures doesn’t symbolize a wave of homeowners suddenly incapable of mortgage upkeep. It represents a backlog. The majority of these foreclosures might have materialized during the pandemic but were postponed due to a slew of moratoriums. It's more of a catch-up rather than a new phenomenon.” Echoing this sentiment, a recent piece by Bankrate notes:

“Contrary to the post-2008 era, when foreclosures inundated the market, causing property value nosedives, today’s scenario is different. The majority of homeowners have substantial equity cushions. Pandemic-induced halts meant foreclosures were at an all-time low in 2020. Today’s slight rise pales in comparison to those dark days.”

A simple look at the graph showcasing foreclosure filings from the first half of each year since 2008 reinforces this sentiment, underscoring that today’s foreclosure activity is a far cry from the crisis levels of yesteryears.

Today's Homebuyers: A Sturdier Foundation

Another distinction from the 2008 crash is the profile of today's homebuyers. Modern-day purchasers are generally more qualified and have exhibited a lower tendency to default, further bolstering the market's resilience.

In Conclusion

Foreclosures are indeed seeing an uptick. However, understanding the nuanced reasons behind this rise is essential. When evaluated against the backdrop of the 2008 crash and considering the more robust profile of today's buyers, it's evident that today's housing market remains on firm ground.

8-4-2023

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans