Our Blog

Recent:

Embarking on Your Homebuying Journey: The Power of Pre-Approval

As autumn paints the leaves with golden hues, you might be considering the prospect of buying a home. The current housing landscape presents challenges with escalating home prices and scarce listings, creating a competitive arena for potential buyers. However, with the right strategy, you can sail smoothly. Starting with a mortgage pre-approval could be your compass to successful homebuying.

Understanding Pre-Approval and Its Significance

So, what is this pre-approval, and why is it crucial? The essence of pre-approval lies in its role in the homebuying process. It involves a lender examining your financial credentials to determine the maximum amount they're ready to lend you. As Freddie Mac elucidates:

“Think of pre-approval as your lender's nod, signaling their readiness to support your home dream by offering you a specific loan amount. However, always borrow what you're confident of repaying.” The present market, with its towering prices and mortgage rates, makes it indispensable to understand your borrowing capacity. Pre-approval imparts this clarity, enabling you to fathom your options with confidence.

The Competitive Edge of Pre-Approval

Given the lopsided equation between the number of buyers and available homes, it's common to find oneself amidst multiple offers. However, brandishing a mortgage pre-approval can tilt the scales in your favor.

As highlighted by a Wall Street Journal (WSJ) piece:

“Amidst the home search labyrinth, pre-approval isn’t just a beacon, it's a sword. It not only assists in gauging your budget but also endows you with an advantage over fellow buyers.” In the seller's eyes, a pre-approved buyer emerges as a credible contender. It assures the seller of your financial robustness, indicating that the transaction is less likely to stumble upon monetary hiccups.

Bottom Line

Starting your homebuying odyssey with a pre-approval sets the stage right. Being prepared enhances your chances of securing the home you've been dreaming of. Forge ahead by partnering with a reliable lender, ensuring you're equipped to navigate the intricacies of today's housing market.

9-29-2023

Homeownership: Beyond the Financial Benefits

The journey of purchasing and owning a home extends far beyond the financial dimensions. While the economic aspects of homeownership are undeniable, the intangible benefits provide a deeper connection, turning a house into a genuine home.

Delve into the invaluable non-financial perks of owning a home.

Mastery Over Personal Space

A staggering 94% of participants in a Fannie Mae survey highlighted the significance of "Having Control Over What You Do with Your Living Space." Owning a house empowers you to tailor it, ensuring it's a reflection of your personality and preferences. From intricate decorations to extensive renovations, the choices are endless. As Investopedia articulates:

“Homeownership endows you with a unique slice of the world, allowing limitless customization. No longer do you need a landlord’s nod for every change you wish to make.” Renting may restrict your ability to infuse personal touches. But with ownership comes the liberty to truly make the space your own, enriching your connection to it.

A Stable Environment for Family Growth

The survey by Fannie Mae revealed that 90% value "Having a Good Place for Your Family To Raise Your Children" as a prime advantage of homeownership. Your family's life stages play a pivotal role. U.S. News emphasizes:

“Especially for families with young children, establishing roots by purchasing a home offers immense stability. The unpredictability of rent hikes or lease terminations should never jeopardize one's sense of security.” Life is inherently fluid, with myriad changes. Amidst this flux, a constant, comforting home can be an anchor of stability for you and your loved ones.

An Enhanced Sense of Community

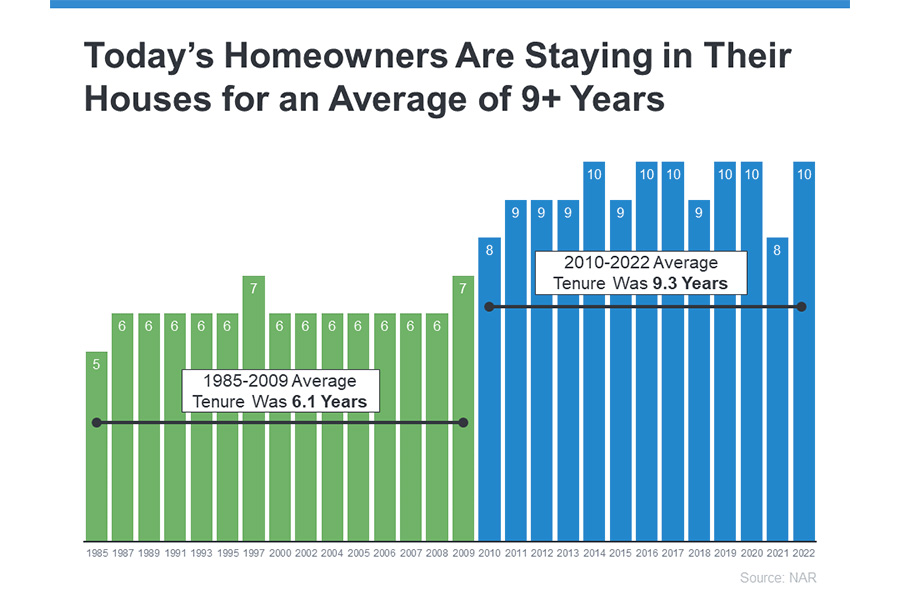

With homeownership comes an amplified engagement with the local community. Fannie Mae's study indicates that 82% of respondents feel this communal connection is an intrinsic benefit of owning a home. Data from the National Association of Realtors (NAR) suggests homeowners typically reside in their homes for an average span of nine years. Over time, this nurtures profound bonds with neighbors and the larger community. Gary Acosta, the CEO and Co-Founder at the National Association of Hispanic Real Estate Professionals (NAHREP), underscores:

“Homeowners often immerse themselves more actively in community affairs..." Your home becomes more than just four walls; it's an avenue to forge relationships and make meaningful contributions to your surroundings.

Bottom Line

Homeownership is a multi-faceted experience. Beyond financial gains, it offers a tapestry of intangible rewards such as accomplishment, pride, continuity, and community integration. Contemplating homeownership? Let's embark on this transformative journey together.

9-27-2023

The Rise of Remote Work and Its Impact on Home Buying

The landscape of the American workplace has experienced a monumental shift, with remote work taking center stage. Predictions indicate that by 2025, a whopping 36.2 million Americans will embrace remote work – a staggering rise of 417% from the pre-pandemic era of a mere 7 million remote workers.

If you're a homebuyer who has adopted a remote or hybrid work style, this evolution in work culture could be a game-changer, especially given the current challenges of housing affordability and inventory.

Remote Work and Housing Affordability

Embracing remote work can reshape your home buying approach. The eradication of daily commutes means living in close proximity to the office may no longer be a top priority. By considering homes slightly farther from urban cores, you could potentially tap into a wealth of more affordable housing options. As Fannie Mae notes:

“With the rise in remote working, we've observed a heightened willingness among workers to relocate or live at more distant locations from workplaces, possibly driven by housing affordability...” This geographical flexibility can enhance your prospects of discovering homes that align with your budgetary constraints. A chat with your real estate agent about expanding your search parameters might be fruitful.

Expanding Home Choices with Work Flexibility

Broadening your home search horizon doesn't just mean finding affordable options; it also paves the way for acquiring more bang for your buck. With the ongoing housing shortage, zeroing in on a house that ticks all boxes can be daunting.

However, expanding your search parameters opens the doors to a plethora of choices, increasing the likelihood of landing a home that resonates with your lifestyle aspirations. This could mean bigger homes, varied architectural designs, or neighborhoods brimming with amenities that were earlier unattainable.

The premium placed on living next door to the workplace, often at a steep price, is now evolving. With the freedom bestowed by remote work, the decision-making process has shifted from commute considerations to prioritizing affordable homes that don’t skimp on desired features.

Bottom Line

The transition to remote work offers more than just occupational flexibility; it's an invitation to reimagine your home-buying journey. Unshackled from geographical constraints, you now have the liberty to delve deep into the housing market. Ready to harness this newfound freedom? Let's collaborate to turn your dream home into a reality.

9-25-2023

Understanding Home Equity and Its Role in Your Next Move

Considering selling your home? One significant concern you might be grappling with is the current mortgage rates. While it's natural to hesitate about moving into a higher rate with your next home, it's essential to remember the high equity landscape of today's housing market. Here’s an in-depth look.

Demystifying Home Equity

To put it simply, equity represents the portion of your home that you truly own. As explained by Bankrate:

“Home equity reflects the section of your home you've fully paid off, distinguishing between your home's current worth and the outstanding amount on your mortgage. It’s the consequence of increasing property values over time paired with the gradual reduction of your loan's principal.” In essence, equity is the difference between your home's present value and the remaining amount on your home loan.

Current Home Equity Landscape

Recent times have seen a surge in equity growth for many homeowners. As highlighted by CoreLogic:

“The average homeowner in the U.S. now boasts an equity of around $290,000.” This surge is primarily due to a significant rise in home prices in the past years. Even though the market is beginning to find its equilibrium, the demand for homes still exceeds available listings. This sustained demand continues to push home prices upwards.

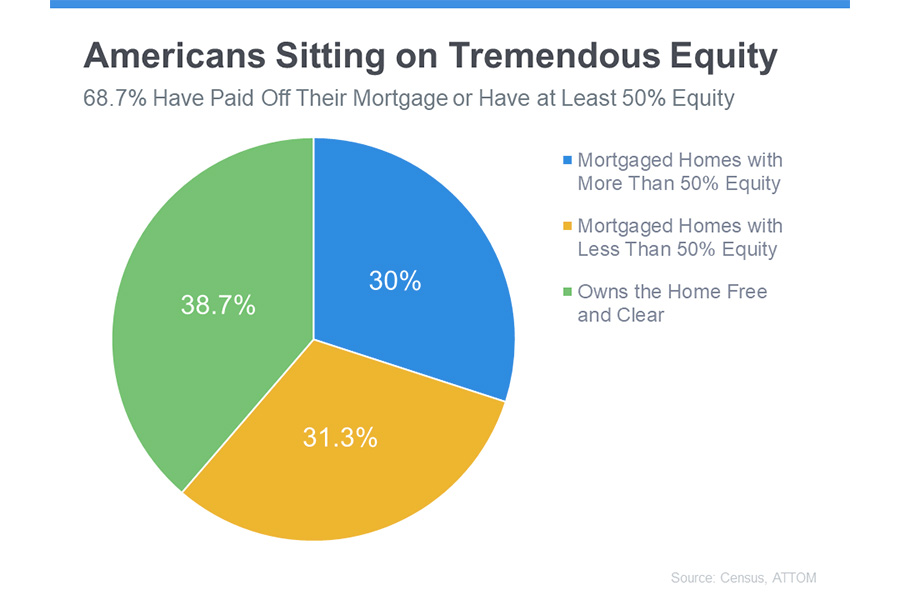

Recent data from agencies like the Federal Housing Finance Agency (FHFA), the Census, and ATTOM suggests that almost 69% of homeowners either own their homes outright or possess at least 50% equity.

The Power of Equity in Addressing Affordability

In today's market, where affordability is a concern for many, equity stands as a potent tool for homeowners. Here’s how it can be instrumental when you decide to move:

-

Buying with Cash: If you've spent a significant time in your current home, your accumulated equity might be substantial enough to purchase a new house outright. This way, you circumvent the need for a loan and the accompanying interest rates. As noted by the National Association of Realtors (NAR): “All-cash home buyers are strategically evading higher mortgage interest rates...”

-

Opting for a Larger Down Payment: You can channel the equity from your current home towards the down payment for your next. This might even enable you to make a heftier down payment, reducing the amount you need to borrow. As Experian states: “Boosting your down payment can reduce the principal loan amount, potentially fetching you a more favorable interest rate from your lender.”

Bottom Line

If you're on the fence about making a move, remember the power of the equity you've accumulated over the years. It could be a game-changer in today's market conditions. To gain clarity on your equity position and strategize its optimal use for your subsequent purchase, let’s engage and chart a clear path forward.

9-22-2023

Leveraging Home Equity for Your Retirement Move

Reaching retirement heralds a time of change and an abundance of new opportunities. One significant decision during this period might involve selling your current home to find another that better accommodates your changing needs. The good news is that you might be more prepared for this move than you think. Here is why.

A Closer Look at Your Home Tenure

The average period homeowners retained their homes has seen a surge in recent years. From an average of about six years between 1985 and 2009, the tenure extended to slightly above nine years since 2010 according to data from the National Association of Realtors (NAR).

This trend indicates that many homeowners have stayed in their homes for a substantial duration, adapting and evolving through various life phases while residing there. Given the change in needs that accompany different life milestones, you might find that your current home no longer serves your requirements, ushering in the opportunity to explore better options that align with your present needs.

The Role of Home Equity in Your Next Move

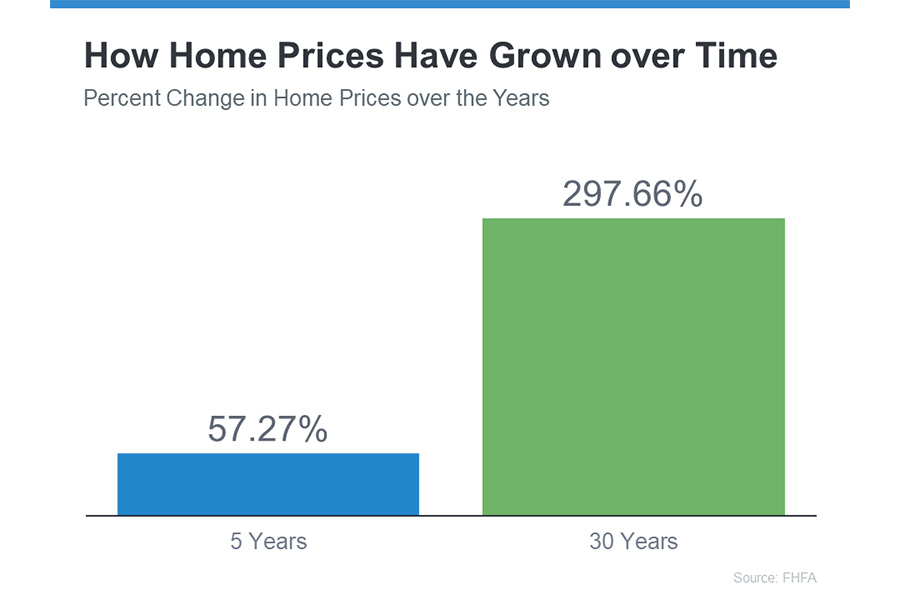

The extended period in your home likely means that you have accumulated significant equity, a resource that can significantly aid in planning your move. Home equity builds up as you reduce your loan amount and as the value of your home appreciates over time.

National data from the Federal Housing Finance Agency (FHFA) paints a promising picture, where homeowners witnessed nearly 60% appreciation in their home value over five years. This percentage jumps dramatically for those who have owned their homes for 30 years, with the home value nearly tripling in that span.

This accrued equity stands as a powerful tool, whether your plans involve downsizing, moving closer to your loved ones, or relocating to a dream destination. A reliable real estate agent can guide you in leveraging this equity optimally, helping sell your current home and finding a new one that resonates with your lifestyle today.

Bottom Line

Retirement planning is a pivotal process, and understanding how to use your built-up home equity can play a crucial role in facilitating a smooth transition into this new chapter of life. Let’s collaborate to discern the exact amount of equity you have garnered over time, and devise a plan to channel it towards securing a home that caters to your evolving needs.

9-20-2023

Understanding Home Price Trends: A 5-Year Forecast

As you plan your home purchase journey, understanding the future trajectory of home prices is vital to secure a sound investment. Contrary to certain pessimistic viewpoints propagated over the past year, the real estate market is displaying a positive trend with home prices rising nationally. Moreover, expert projections anticipate a continuation of this upward trend. Let's delve into what this means for potential homebuyers.

A Consistent Rise in Home Values

Recent data sourced from a Pulsenomics survey, which encompassed insights from over a hundred professionals including economists, investment strategists, and housing market analysts, underscores a consensus towards a steady appreciation in home prices over the upcoming five years. The Home Price Expectation Survey (HPES) reveals a year-on-year increment through 2027, illustrating a return to a more normative pattern in home price growth.

It is crucial to note that while the projected increase for 2024 may appear smaller compared to that of 2023, home price appreciation operates on a cumulative basis. This means a home appreciating by 3.32% this year would further grow by 2.17% the following year, showcasing the long-term benefits of homeownership.

The Impact on Individual Wealth

The trajectory of home price appreciation not only influences the housing market but directly affects individual household wealth. Utilizing projections from the HPES, it is conceivable that a home bought for $400,000 at the start of the year could foster an increase in household wealth exceeding $71,000 over the next half-decade. This exemplifies the potency of home investment as a tool for substantial long-term wealth accumulation.

Bottom Line

Experts predict a sustained, moderate growth in home prices over the next five years, providing a favorable landscape for aspiring homeowners. Buying a home today can hence be a strategic step towards long-term financial success, aiding in the growth of both home values and personal net worth. If you envision yourself as a homeowner in the near future, it is prudent to initiate the home buying process at the earliest. Let's collaborate to make informed decisions and navigate the home buying journey successfully.

9-19-2023

To Buy or to Rent: A Conundrum for Baby Boomers

If you belong to the baby boomer generation and have spent a considerable part of your life in your current residence, the thought of moving to a new place brings along various questions — the most significant one being whether to rent or to buy your next home. The answer to this revolves around your individual circumstances and aspirations for the future. Let's explore the two pivotal aspects that can influence this decision.

The Persistent Rise in Rents

Based on data from the Census, it's evident that rents have been on a continuous upward trajectory since 1988. If you opt to rent, it would mean possibly encountering an increase in rental payment with each lease renewal, a financial strain that could grow annually.

In contrast, purchasing a home with a fixed-rate mortgage grants you the ability to have stable monthly housing payments, securing your financial expenditure in the long term. As articulated by Freddie Mac, this approach ensures little to no alteration in your monthly housing expenses throughout your loan's lifespan, a stability that stands resilient despite fluctuations in other life costs.

Advantages of Home Ownership

A study by the AARP emphasizes that buying generally supersedes renting when considering long-term benefits, offering a plethora of advantages that enhance your quality of life and financial security. Here are a few merits of homeownership highlighted in their report:

-

Asset Accumulation: Being a homeowner allows you to accumulate equity over time, fostering a reservoir of generational wealth that could potentially enhance the lives of your descendants.

-

Potential for Mortgage-Free Living: If your current home's equity suffices to purchase your next residence outright, you can relish the freedom from monthly mortgage payments, albeit with the responsibility for property taxes and maintenance fees.

-

Ease of Aging in Place: Owning your house facilitates the ease of customizing it according to your evolving needs, making everyday living more comfortable and suited to your preferences.

Bottom Line

As a baby boomer pondering over the decision to buy or rent post selling your existing house, a personalized consultation can be instrumental in steering your choice in the right direction. Given the rising rent scenario coupled with the multifaceted benefits of owning a home, purchasing your next abode could potentially emerge as the prudent route. Let's connect to weigh the pros and cons tailored to your situation and make an informed decision in navigating your next chapter seamlessly.

9-18-2023

Unraveling the Housing Inventory Conundrum

If you find yourself in the market pondering over the limited housing options available, you're not alone. The pressing question is: why is housing inventory at such a low ebb? While postponing your move until the market rebounds with more options might seem prudent, it might not be the ideal strategy. Let's delve into the root causes of this predicament and why acting now might be beneficial.

The Chronic Underbuilding Issue

A pivotal reason behind the dwindling inventory is the persistent underbuilding problem stretching over the last 14 years. During this period, the construction of new homes substantially lagged behind the historical average, engendering a notable deficit in housing inventory. While there has been a resurgence in home construction meeting the historical norms recently, resolving the prolonged inventory shortfall is far from an overnight task.

The Mortgage Rate Lock-In Effect

The current market is grappling with the mortgage rate lock-in effect, where homeowners are hesitant to sell due to prevailing mortgage rates. Many are unwilling to forego their existing favorable rates for higher ones accompanying a new home. However, it is crucial for them to weigh their requirements alongside the financial facets of the move.

The Media's Role in Fueling Fears

Misinformation and apprehension fostered by media reports have further strained the housing inventory. Contrary to doomsday predictions of a housing crash and plummeting home prices, the real estate sector has held its ground. Jason Lewris, Co-founder and Chief Data Officer at Parcl, emphasizes the escalating fear, uncertainty, and doubt dictating real estate choices due to unreliable information.

This unsettling environment, spearheaded by media narratives, has rendered potential sellers hesitant, although the market scenario is far from bleak. Consulting a knowledgeable agent could help dispel these misconceptions, offering a realistic picture of the market dynamics.

The Implications for Buyers and Sellers

For Buyers: The restricted inventory necessitates a meticulous evaluation of all available options, expanding your search to diverse locales and housing varieties. Leveraging the expertise of a professional can facilitate a comprehensive exploration of available opportunities, aligning with your preferences.

For Sellers: The present low inventory scenario works to your advantage, enabling your property to garner more attention. Collaborating with a real estate agent can elucidate the perks of selling in the existing market conditions. Moreover, agents can keep you abreast of the newest listings in your vicinity, aiding in locating your next ideal home.

Bottom Line

The issue of low housing inventory is not a newfound dilemma but a result of various long-standing and immediate factors. Navigating this landscape necessitates insightful guidance to understand the ongoing trends and their impact on your plans. Let's connect to steer through the intricacies of the current market, empowering you with expert advice to make informed decisions.

9-15-2023

A Glimpse of Change: An Unusual Uptick in Home Listings

The real estate market is at a pivotal juncture with a notable factor influencing its dynamics - the number of homes available for sale. If you are contemplating selling your home, the current low housing inventory presents a golden opportunity for your property to stand distinct, particularly if it is aptly priced.

A Surge in New Listings: What It Signifies

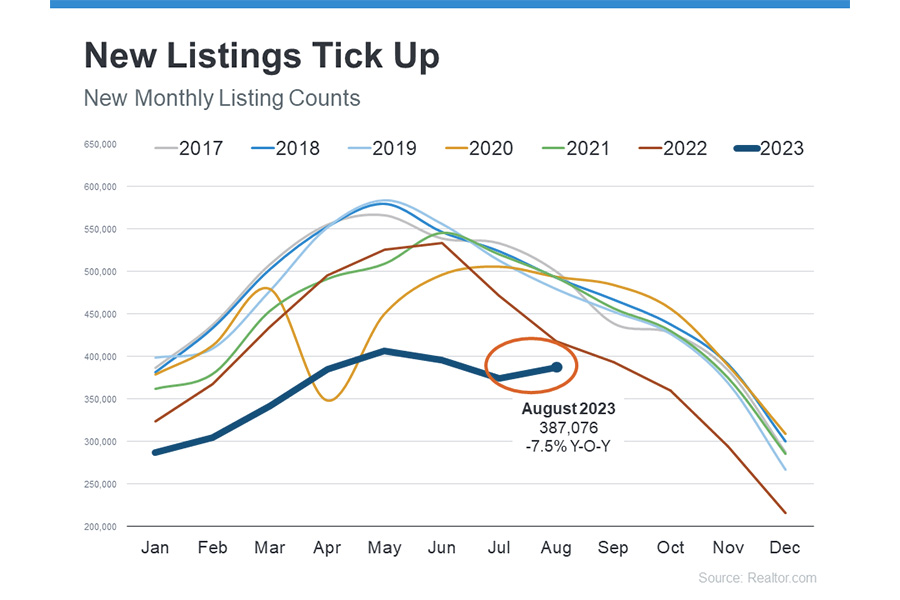

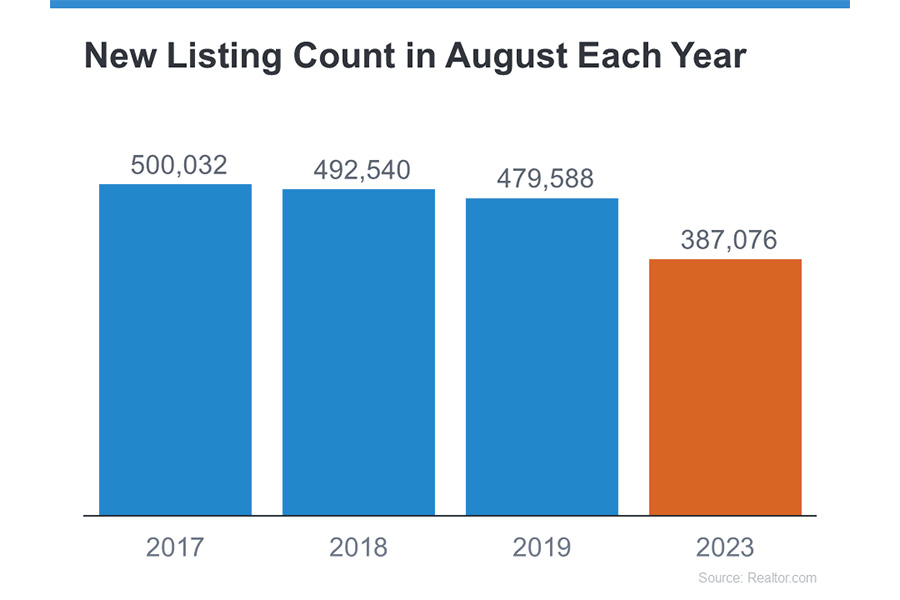

The industry is witnessing encouraging signals with an uptick in new listings. Recent data suggests that more homeowners are venturing to list their properties, a trend that merits attention due to its implications for sellers.

Deviation from the Traditional Seasonal Trend

Traditionally, the real estate market experiences a whirlwind of activity during the spring buying season each year, with a discernible rise in new listings during the first half of the year. However, as we steer into the later months characterized by the commencement of the school year and the onset of holidays, the market usually tones down.

Contrary to this established pattern, the latest insights from Realtor.com reveal a surge in home listings in August, an anomaly in the seasonal trend. Elaborating on this, the report states:

“A remarkable rise in new home listings in August, diverging from the usual trend, potentially heralds a rejuvenated seller activity as we move into fall.”

While this phenomenon is based on a single month’s data, it certainly catches the eye, urging sellers to remain alert to the evolving landscape.

Navigating the Changing Market Dynamics

For potential sellers postponing their decisions, this might be the opportune moment to act, leveraging the present advantages before a potential influx of competition. The lingering concern is sharing the spotlight with other sellers, a situation best avoided by taking a proactive stance and listing your property now.

Though an increase in listings is observed, it is pertinent to note that the market still grapples with a substantial inventory deficit, a condition not expected to reverse abruptly. The current scenario elucidates the pronounced opportunity awaiting sellers in the existing market conditions, as depicted in the accompanying graph.

Bottom Line

In a market still characterized by low inventory but showing signs of a gradual increase in listings, selling your home now could be a strategic move. Despite the looming competition, the scales are tipped in favor of sellers, promising substantial benefits. Let's join hands to navigate this promising market and secure the best value for your property before a potential rise in neighborhood listings.

9-13-2023

September 2023 Newsletter

Welcome to this month's edition of our newsletter, where we delve into a variety of engaging topics designed to empower you as a homeowner.As always, we are here to empower you with timely insights and tips that allow you to make the most of your home ownership experience. This month, we are tackling topics that are front and center as we fully immerse ourselves in the beautiful autumn season.

Before we dive into these exciting topics, we would like to take a moment to express our gratitude. Your friendship and the trust you place in us through your referrals mean the world to us. We appreciate your support and remain dedicated to providing valuable insights. Enjoy the read!

Warmest regards,

Bill Watson

President / Managing Broker

Your Home Sold Guaranteed Realty - The Watson Group

6155 S Main Street, Suite 270

Aurora, CO 80016

720-463-0002

bill@watsonrg.com

www.yourhomesoldguaranteedrealtyco.com

P.S. In the upcoming weeks, if you hear people discussing real estate, please feel free to tell them about my free consumer information! This useful resource can be very beneficial for anyone who wants to learn more about real estate.

This summer, you might come across individuals who were relocated and want to purchase a home. By sharing my Free Consumer Report "Cash Savings Guarantee," you can assist them in purchasing their ideal home at a lower cost than they anticipated. To obtain a copy for someone else, contact me at 720-463-0002.

SELL YOUR HOME FAST and for TOP DOLLAR! Get this FREE Report that

Reveals 27 Tips to Give You the Competitive Edge! www.Our27Tips.com

Going Above and Beyond for

Homebuyers and Homesellers

At Your Home Sold Guaranteed Realty - The Watson Group, we pride ourselves on making the process of buying or selling a home as seamless and stress-free as possible. Our team of seasoned real estate agents will guide you through the intricacies of the real estate market, helping you find your dream home or secure the best possible price for your property. Our unique selling point lies in our buyback and satisfaction guarantees. These offers provide buyers with confidence, knowing that if their new home doesn't meet expectations, we'll buy it back within 12 months.

See What Our Amazing Fans Have to Say

Visit www.OurAmazingFans.com

Receive Multiple Cash Offers on Your Home Today!

Are you looking to sell your home quickly and for a fair price? Look no further than our Exclusive Cash Offer Program. Our program is designed to give homeowners access to multiple cash offers on their homes in just minutes. With our cutting-edge technology, we can provide real estate investors with the data they need to make informed decisions about your property.

No Waiting To Receive an Offer

No Home Prepping For Sale

No Strangers in Your Home

No Open Houses

Don't wait any longer - sign up now and start receiving multiple cash offers!

www.GetaCashOnlyOffer.com

Make Raking a Breeze

It’s that time of year again when leaves will change into their autumnal colors before falling from the trees…and into our yards. This year, make raking easier on you and your back by following these tips:

- Choose the right rake — look for one that has a wider tine spread, aiming for 30 inches, and is labeled “no-clog.”

- Separate your lawn into quadrants and rake into rows to save time and make the most of your efforts.

- Take advantage of a soft breeze and rake in the same direction rather than against it.

- Bag the leaves as soon as you’ve raked so a gust of wind doesn’t undo your work.

Subscribe to Our Newsletter

HIGHLINE EAST AT DAYTON TRIANGLE

Only 1 Home Remains!

The community has been meticulously crafted to redefine modern living, offering an exclusive blend of sophisticated architecture, considerate floor plans, and outstanding craftsmanship. With only one home left, Highline East stands as the ultimate residential destination for those who desire unparalleled comfort and wish to seize this final opportunity.

Meet Our Team of Experts

Committed to Your Real Estate Success

Your Home Sold Guaranteed Realty - The Watson Group is composed of experienced and committed real estate agents dedicated to achieving your property goals.We address your concerns, answer your questions, and equip you with the knowledge necessary to make well-informed decisions. Setting us apart are our exclusive guarantees: our buyback guarantee underscores our confidence in the homes we sell, and our satisfaction guarantee promises you'll love your new home or we'll buy it back within 12 months. Choose us for a personalized, success-focused real estate experience.

Find out the value of your home by answering a few simple questions. By providing your address and home description, the system will produce a complete market analysis through a search for similar homes sold and listed in your area.

AT MURPHY CREEK

Welcome to Elevations at Murphy Creek by Montano Homes - the perfect place to call home! This central master-planned community provides easy access to DIA, Southlands Mall's gourmet dining and shopping options, and offers stunning views of one of Colorado's finest links-style golf courses.

Now Selling from the High $400's

Find out how this changing market has affected your home value! Your home may be worth more than you think.

Visit www.AccurateHousePrice.com or Call Us at720-463-0002.

This is a FREE service with NO OBLIGATION to list.

Home Sale Phenomenon

11,000 Houses Daily

In the realm of real estate, the rhythm of the market can often be a complex dance. It sways with demand, pirouettes with economic influences, and occasionally waltzes into periods of seemingly dormant activity. For homeowners hesitating to list their property due to perceived market lethargy, here's an . . .

Not Ready to Sell? Text your address to 720-605-1268 to find out what your home will sell for today. You will not receive a phone call, just a text!

Subscribe to Our Newsletter

Sustainability Myths

There’s a lot of information out there when it comes to sustainability, and not all of it is true. Let’s take a look at a few myths when it comes to sustainability, and what we can do instead.

- Paper bags are better than plastic: according tohttps://environment.coit takes four times as much energy to produce a paper bag than a plastic one. Your best bet: a reusable bag.

- Recycling is sustainable: not all products that can be recycled are. Check with your local provider to see if that milk carton or pizza box can indeed be recycled where you live.

- New windows save energy: since windows don’t take up much surface area in our homes, replacing them won’t save that much energy. High estimates say you can save 10% on energy bills, while others say you won’t even notice a difference. Instead, concentrate on insulation first which can save more and is cheaper to do.

- Sustainability is a trend: quite the opposite. In an effort to meet consumer demand, companies and brands are taking action to lessen their environmental impact.

A Heartfelt Message to our Special Clients and Friends . . .

It is our pleasure to extend a warm welcome to all of the new clients we have had the honor of working with recently, and also offer special thanks to our Raving Fans.

Kylie Bearse

Daniel Strough

Brenda Childress

Cornelius Sanders

Rick & Cora Walkup

Robert & Cherlyn Mollitor

Our business would not be where it is today without your trust!

Recently Sold Properties

by The Watson Group

Lower Highlands

Sold for $1,125,000!

Creekside Eagle Bend

Sold for $800,000!

Willow Creek

Sold for $900,000!

Founders Village

Sold for $565,000!

Tallyn's Reach

Sold for $700,000!

Sunset Terrace

Sold for $530,000!

Crystal Valley Ranch

Sold for $644,900!

Tollgate Village

Sold for $478,000!

Real Estate Corner . . .

Q: Can I use a financial gift from a friend or relative as a down payment on buying a home?

A:Yes, one in four first-time homebuyers utilizes a gift to fund their down payment. As of 2023, tax laws permit gifts up to $17,000 annually without incurring tax implications for either the giver or receiver (though this amount is subject to yearly adjustments, so it's advisable to check IRS.gov for the latest "gift tax" figure). Thus, one could receive a combined gift of $34,000 from two separate individuals without triggering a gift tax. Such a gift can facilitate home buying, even for properties that aren't FHA-approved. Therefore, it's highly recommended to engage a knowledgeable REALTOR® early on and discuss this strategy before commencing your home search.

Want to learn more? Read our six strategies “Negotiating Tips: Get the Highest Price You Can when You Sell Your Home” to help you secure the right price when selling your home.

Do you have a real estate question you want answered? Feel free to call me at720-463-0002. Perhaps I’ll feature it in my next issue!

9-12-2023

Navigating Affordability: A Shift Towards Less Expensive New Homes

In the dynamic landscape of today's housing market, buyers face the twin challenges of surging mortgage rates and escalating home prices, primarily fueled by a scanty inventory. This scenario is prompting many prospective homeowners to seek more budget-friendly options, with a notable pivot towards newly built homes, which now constitute a significant portion of the existing inventory.

A Surge in Affordable New Home Sales

Recent data from the Census illuminates a trend where buyers, this June, preferred newly built homes falling in a more economical price bracket compared to 2022. Remarkably, home sales under $500,000, which stood at 58% last year, soared to 65% this June, signifying an evident preference for cost-effective new constructions amidst the prevailing affordability crunch.

Builder Responses to Affordable Home Demand

Builders are tuning in to this palpable shift, introducing smaller homes that match modest price points. George Ratiu, a leading economist at Keeping Current Matters, confirms this emerging pattern:

"We are witnessing a strategic market shift where builders are leveraging the demand for affordable housing by offering slightly compact yet quality homes."

Supplementing this insight, Mikaela Arroyo, a figurehead at John Burns Real Estate Consulting, recognizes the empowerment this shift offers to potential homebuyers:

“This conscious resizing by builders is essentially crafting avenues for many to own an affordable, entry-level home, opening up a realm of opportunities.”

How Real Estate Agents Can Facilitate Your Search

In these changing dynamics, a local real estate agent can be your linchpin to navigate the options deftly. Agents bring to the table an expansive knowledge of the freshest inventory, inclusive of homes under construction or newly erected, offering a bespoke approach to find a home that fits your budget without compromising on quality.

Bottom Line

With the housing market leaning towards affordability through newly built, cost-effective homes, it’s an opportune moment to delve into the property landscape. Leveraging the expertise of a seasoned real estate professional can unveil a spectrum of choices, even in a market constrained by budgetary concerns.

9-11-2023

Why The Watson Group is the Best Choice for Sellers in 2023

In the swirling storm of real estate jargon and over-promises, one brand stands out not just for its name, but for its guarantee - Your Home Sold Guaranteed Realty - The Watson Group. Let’s unpack this.

Predictability in an Unpredictable World

While most real estate agencies play a numbers game, The Watson Group emphasizes certainty. The name isn't a mere marketing gimmick; it's an iron-clad commitment. In an era of uncertainty, especially in the volatile property market of 2023, a guaranteed sale is more than just reassuring; it's a game-changer.

Decades of Track Record

History often dictates the future. The Watson Group has sculpted a rich legacy in the real estate sector. Our heritage isn't just a testament to our endurance but an endorsement of our excellence. In an industry where many fade away, our prolonged presence is a badge of trust.

Direct Response Marketing

The Watson Group embraces the power of direct response. Instead of passively listing homes and waiting for potential buyers, we actively engage, enticing a dedicated audience and driving action. The result? Faster sales, happier clients.

2023 Ready

We're not just living in the present; we're crafting the future. As 2023 continues, we're at the forefront, deploying cutting-edge technology, sophisticated analytics, and innovative showcasing methods. When your property is with The Watson Group, it's not just seen; it's remembered.

Our Network = Your Net Worth

In the real estate world, connections matter. Our vast network, cultivated over the years, is a gold mine of potential buyers, sellers, and market influencers. Every property we list immediately garners attention, not just from casual browsers but from serious, interested parties.

The No Stone Unturned Policy

Attention to detail is not our strategy; it’s our ethos. Every process, every communication, every negotiation is handled with meticulous care. This ensures that when you're with The Watson Group, you’re not just another client; you’re a priority.

Education is Empowerment

Information is power. At The Watson Group, we believe in empowering our clients. This means you're always informed, always updated, and always in control. We don’t just sell homes; we build informed homeowners.

Testimonials Don’t Lie

Promises can be empty, but results echo. Dive into our client testimonials, and the recurring themes are clear – satisfaction, trust, and success. These aren't just reviews; they're endorsements of our unwavering commitment.

Competitive Edge with Comprehensive Analysis

Proper valuation is a delicate balance. Using our proprietary market analysis tools, we ensure your home isn't just priced right, but poised for a quick, profitable sale. No inflated figures, no lowballing, just precise, data-driven valuations.

Flexibility with Integrity

While we adapt to the ever-evolving real estate landscape, our core principles remain unyielding. The Watson Group is founded on transparency, honesty, and client-centricity. In 2023, as always, we stand tall, steadfast in our mission and values.

Your Home Sold Guaranteed Realty - The Watson Group is more than a name. It's a promise, a legacy, and your best bet in 2023. Don’t just sell your home; guarantee its sale.

9-8-2023

Mortgage Rates and Treasury Yields: What It Means for Homebuyers

When you're eyeing mortgage rates, understanding the likely direction they're heading can be complex. Mortgage rates are known to be challenging to predict. If you're a homeowner or a prospective buyer, this uncertainty can be disconcerting. But fear not – there's a historical clue that might shed some light on the future of these rates: the relationship between the 30-Year Mortgage Rate and the 10-Year Treasury Yield.

A Historical Perspective

Since Freddie Mac initiated mortgage rate records back in 1972, a clear pattern has emerged between these two metrics. As shown in the accompanying graph, the average spread (difference) between the 30-Year Mortgage Rate and the 10-Year Treasury Yield over the past half-century has consistently remained around 1.72 percentage points (or 172 basis points).

The pattern is quite straightforward: as Treasury Yields increase, mortgage rates tend to follow suit, and vice versa. This synchronization, however, has seen an unexpected twist lately – the spread is widening far beyond its usual range.

The Widening Spread: Why Does It Happen?

Why is the spread between the 30-Year Mortgage Rate and the 10-Year Treasury Yield expanding beyond its typical average? The primary culprit is uncertainty in the financial markets. Factors such as inflation, various economic elements, and Federal Reserve (The Fed) decisions all play a part in determining mortgage rates, contributing to the growing spread.

The Importance for Homebuyers

While these details may seem overly technical, understanding this spread holds substantial significance for potential homebuyers. It essentially implies that, according to the historical norm, there is potential for mortgage rates to become more favorable today.

Experts, too, agree that improvement is on the horizon, given that inflation continues to subside. Odeta Kushi, Deputy Chief Economist at First American, encapsulates this sentiment:

"The assumption that the spread, and thereby mortgage rates, will decrease in the latter half of the year if the Fed eases its monetary tightening measures is reasonable. However, it's improbable that the spread will revert to its historical mean of 170 basis points, as some underlying risks persist."

A piece from Forbes reinforces this perspective, stating:

"While mortgage rates are expected to remain high due to ongoing economic uncertainty and the Federal Reserve's efforts to combat inflation, it's believed that rates have already reached their peak last fall and will likely descend to some extent later this year, barring unexpected surprises."

The Bottom Line

Whether you're dipping your toes into homeownership for the first time or considering a move to a home that better suits your present needs, staying informed about mortgage rates and expert projections for the coming months is vital.

Understanding the relationship between the 30-Year Mortgage Rate and the 10-Year Treasury Yield is more than an exercise in financial geekery. It's a tool that can help you anticipate market trends and make informed decisions about one of life's most significant investments: your home.

Don't be daunted by the numbers and jargon. At Your Home Sold Guaranteed Realty, we're here to break it down for you, making the complex simple and the uncertain clear. Mortgage rates may be unpredictable, but with insights like these, you'll be better prepared for whatever the market brings.

9-6-2023

Dispelling the Myth of Looming Foreclosures

With the increasing costs spanning from grocery bills to fuel, the chatter around the water cooler suggests that homeowners may soon struggle with their mortgage obligations, inevitably leading to a surge in foreclosures. While there’s a slight uptick in foreclosure filings compared to the previous year, the larger sentiment from industry experts is clear: A massive wave of foreclosures is not on the cards.

Bill McBride of Calculated Risk, known for his astute market observations, notably predicted the 2008 housing debacle. Applying the same meticulous observation to current trends, his statement is unambiguous:

"The narrative of an imminent foreclosure catastrophe is unfounded."

Unraveling the Reasons Behind the Optimism

A Shift in Lending Landscape

A notable reason behind the 2008 foreclosure avalanche was the leniency in lending norms, allowing many to secure mortgages without robust checks on their repayment capacities. The landscape today is distinctly different with stringent lending standards. This translates to borrowers who are not just qualified on paper, but in practice, with genuine financial capabilities to uphold their mortgage responsibilities.

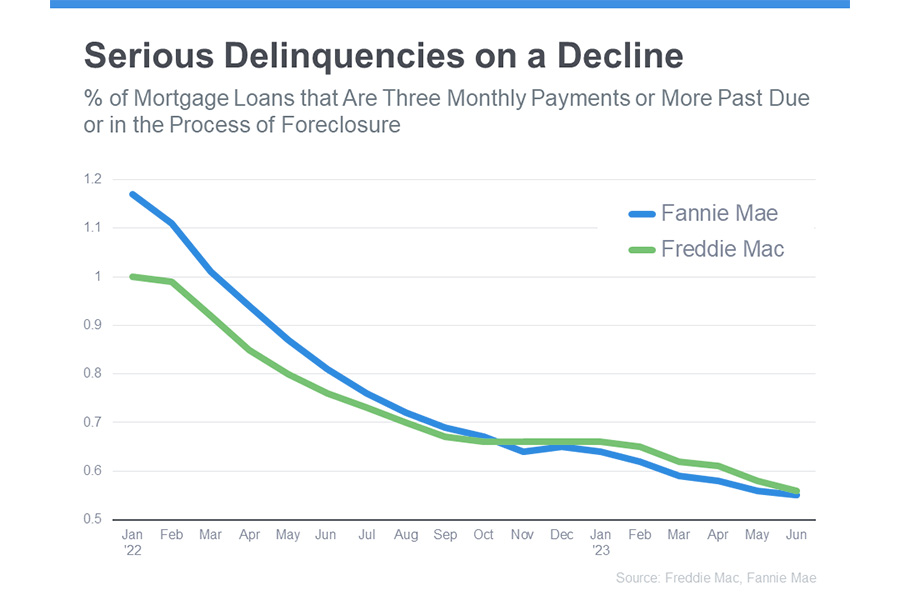

A Decline in Delinquencies

A crucial indicator to gauge the potential of foreclosures is to examine the number of homeowners defaulting on their payments. Contrary to some speculations, statistics from stalwarts like Freddie Mac and Fannie Mae indicate a decline in serious mortgage delinquencies.

Molly Boese, a respected voice at CoreLogic, sheds further light:

“The rate of serious mortgage delinquencies, which saw an alarming increase in 2021, has now reverted to numbers comparable to those from early 2020. This reflects a stable mortgage landscape.”

For a foreclosure storm to take place, it’s imperative for a significant chunk of homeowners to default on their payments. With the majority currently staying consistent with their obligations, the prospects of such a surge are minimal.

Concluding Perspective

The concerns around a potential avalanche of foreclosures might be rooted in genuine concern, but the current data provides reassuring counter-evidence. Today’s market, characterized by responsible lending and committed homeowners, is a far cry from conditions that precipitate mass foreclosures.

9-4-2023

Unleashing Home Equity: An Important Tool for Potential Sellers

Homeowners today find themselves at crossroads, deliberating over whether to make the sale or hold onto their property, primarily due to concerns about the potential implications of higher mortgage rates on their subsequent purchase. However, the key to unlocking confidence in this decision may lie in understanding and harnessing home equity. Let’s unravel the power of equity and how it can redefine your homeownership narrative.

Demystifying Home Equity

At its core, equity represents the difference between the current market value of your home and the outstanding amount on your mortgage. A heartening revelation for homeowners has been the rapid and significant appreciation of this equity in recent years.

A combination of soaring home prices in the past and an ongoing supply-demand imbalance has put upward pressure on property values. As Rob Barber, the chief at property data giant ATTOM, observes:

"Despite minor market fluctuations, homeowners’ equity has not only remained robust but is also witnessing a resurgence to unprecedented levels."

The Equity Advantage in the Current Market Landscape

The value of home equity extends far beyond mere numbers; it serves as a strategic asset in today’s complex housing market. Current data showcases an optimistic picture: approximately 70% of homeowners either own their homes outright or possess a minimum of 50% equity.

This robust equity position presents multiple opportunities:

-

Down Payment Dynamics: Proceeds from the sale of your home can substantially cover, if not fully fund, the down payment for your subsequent property. This could significantly reduce the quantum of financing required, rendering higher mortgage rates less daunting.

-

Power of Full Payment: For long-term homeowners, accumulated equity might be adequate to facilitate an all-cash purchase, completely circumventing the need for financing and associated interest rate concerns.

Discovering Your Equity Status

Eager to ascertain your precise equity position? A Professional Equity Assessment Report (PEAR) delivered by a reliable real estate expert can provide this crucial insight.

Concluding Thoughts

Equity, often an overlooked facet of homeownership, is proving to be a game-changing element for those contemplating a sale in the present market. If you're mulling over leveraging your home's equity to facilitate a smooth transition to your next abode, the time is ripe for a conversation.

9-1-2023

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans