Our Blog

Recent:

Dispelling the Myth of Looming Foreclosures

With the increasing costs spanning from grocery bills to fuel, the chatter around the water cooler suggests that homeowners may soon struggle with their mortgage obligations, inevitably leading to a surge in foreclosures. While there’s a slight uptick in foreclosure filings compared to the previous year, the larger sentiment from industry experts is clear: A massive wave of foreclosures is not on the cards.

Bill McBride of Calculated Risk, known for his astute market observations, notably predicted the 2008 housing debacle. Applying the same meticulous observation to current trends, his statement is unambiguous:

"The narrative of an imminent foreclosure catastrophe is unfounded."

Unraveling the Reasons Behind the Optimism

A Shift in Lending Landscape

A notable reason behind the 2008 foreclosure avalanche was the leniency in lending norms, allowing many to secure mortgages without robust checks on their repayment capacities. The landscape today is distinctly different with stringent lending standards. This translates to borrowers who are not just qualified on paper, but in practice, with genuine financial capabilities to uphold their mortgage responsibilities.

A Decline in Delinquencies

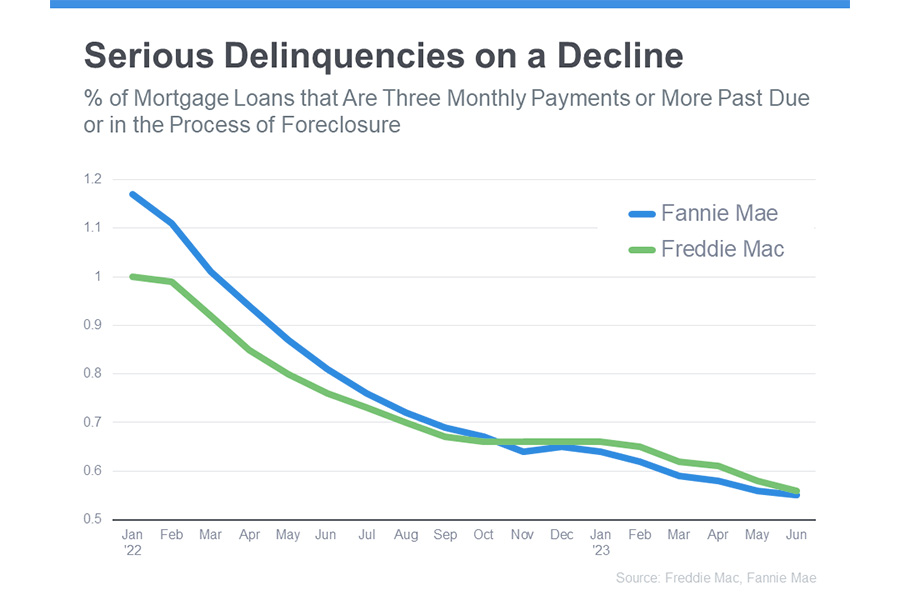

A crucial indicator to gauge the potential of foreclosures is to examine the number of homeowners defaulting on their payments. Contrary to some speculations, statistics from stalwarts like Freddie Mac and Fannie Mae indicate a decline in serious mortgage delinquencies.

Molly Boese, a respected voice at CoreLogic, sheds further light:

“The rate of serious mortgage delinquencies, which saw an alarming increase in 2021, has now reverted to numbers comparable to those from early 2020. This reflects a stable mortgage landscape.”

For a foreclosure storm to take place, it’s imperative for a significant chunk of homeowners to default on their payments. With the majority currently staying consistent with their obligations, the prospects of such a surge are minimal.

Concluding Perspective

The concerns around a potential avalanche of foreclosures might be rooted in genuine concern, but the current data provides reassuring counter-evidence. Today’s market, characterized by responsible lending and committed homeowners, is a far cry from conditions that precipitate mass foreclosures.

9-4-2023

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans